Volunteer tax preparers will take information and file online.

Volunteer tax preparers will take information and file online.

Arizona is among a handful of states joining a pilot program from the Internal Revenue Service that lets taxpayers file their returns directly with the government. But it's not for everyone.

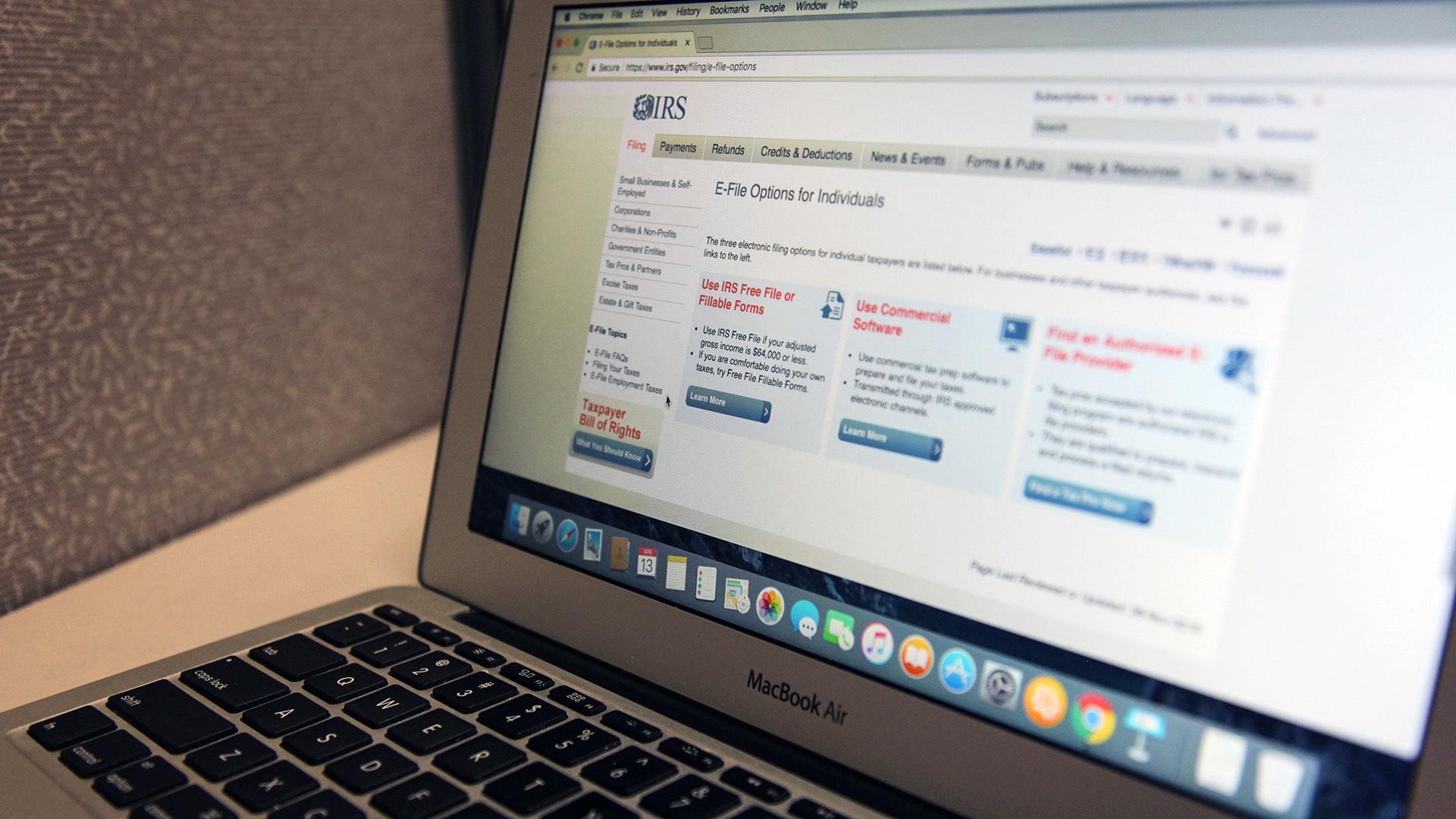

"Direct File" is the name of the trial program that lets American taxpayers do what people in some other countries have done for years - file their tax forms directly on a government web site, without going through an intermediary.

Of the 13 states taking part, only four, including Arizona, California, New York, and Massachusetts, have state income taxes, which complicates the process. Taxpayers in those states will be able to file both federal and state returns through Direct File.

Spokeswoman Rebecca Wilder with the Arizona Department of Revenue said the state joined the IRS pilot program to make tax time more convenient.

"We're always looking for ways to make the tax filing process much easier simpler and smoother, and so it made sense for us to join a pilot project that was already underway," Wilder said.

However, at this early stage, only taxpayers with simple needs will be eligible for Direct File.

"You need to have lived in Arizona all year and not have any income from another state, and only income sources that are eligible are wages, social security benefits, and unemployment benefits. Though it's initially limited in scope we are expecting the program to expand and include more taxpayers over time," Wilder added.

Look for Direct File to be available in January when tax season starts. If you don't qualify for it, IRS Free File will still be available, allowing free tax filing on commercial services for those who qualify.

By submitting your comments, you hereby give AZPM the right to post your comments and potentially use them in any other form of media operated by this institution.